How to Craft a Budget Using FP&A Software for Your Startup

- November 25, 2023

- 2 minutes

Crafting a budget for a startup can often seem like a daunting task involving many variables and a great deal of uncertainty. It demands a meticulous understanding of both current financial standing and future projections. However, this process can be significantly simplified, and the results can be more accurate and insightful, through the utilization of Financial Planning & Analysis (FP&A) software.

FP&A software is a type of financial management tool designed to assist in budgeting, forecasting, reporting, and analyzing a company's financial data. Inherent in its functionality, it provides a robust infrastructure to handle the complexities of financial planning for startups.

Let's delve into the step-by-step process of crafting a budget utilizing FP&A software.

- To initiate the process, the first step is to gather and input historical financial data related to revenue, expenditure, assets, and liabilities into the FP&A software. This allows the software to learn and comprehend the company's financial history. The historical data helps in creating a reference point for future projections.

- The next step involves entering all the fixed costs that the company incurs. This includes salaries, rent, utility bills, and other overhead costs. The FP&A software uses these values to project future fixed costs based on various factors, such as inflation rates or expected salary raises.

- Next, you define the variable costs, which are expenses that change in relation to the volume of a company’s production output. Some examples of these costs include raw materials, distribution costs, and sales commissions. The FP&A software uses these inputs to create various scenarios such as best-case, worst-case, and most likely scenarios.

- The subsequent step involves forecasting revenue. This requires input on the company's sales volume, pricing, market trends, and other relevant factors. The FP&A software uses these inputs to predict revenue, taking into account sales trends, seasonal patterns, and market dynamics.

- Following this, you should consider any potential investments or funding rounds that could influence the company's financial standing. This involves detailed input on expected investment amounts, timelines, and potential returns or revenue impacts.

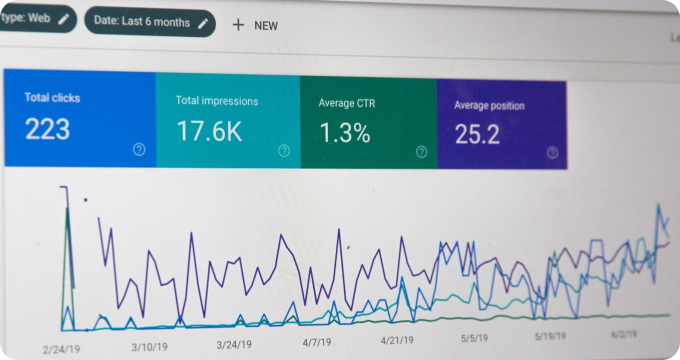

- The final step involves reviewing and assessing the budget. FP&A software offers robust reporting capabilities that provide a comprehensive view of the company's financial health. These reports can be generated in various formats, including charts, graphs, and detailed spreadsheets. This visualization aids in identifying financial strengths, weaknesses, and potential opportunities for improvement.

The multivariate regression analysis feature in most FP&A software plays a crucial role in the budgeting process. Based on the historical data, the software can identify relationships between different variables and how they impact the overall financial performance. This information is invaluable, especially when there is a high degree of correlation between variables, such as sales volume and revenue.

By leveraging machine learning algorithms, FP&A software can provide predictive analytics. This is a significant advantage for startups as they often face uncertain and volatile market conditions. Predictive analytics can provide insights into future trends and potential risks, allowing startups to make informed decisions.

One of the critical trade-offs in using FP&A software is the balance between automation and customization. While automation can simplify the budgeting process and save time, it may not always capture the unique aspects and nuances of a startup's financial situation. On the other hand, customization can cater to the specific needs of the startup but may require more time and expertise to implement effectively.

The utilization of FP&A software for budgeting is not merely about crunching numbers and generating reports. It's about providing a strategic advantage to the startup. By leveraging the capabilities of FP&A software, startups can gain a deeper understanding of their financial health, anticipate future trends, and make informed decisions that drive growth and profitability.

In conclusion, crafting a budget for a startup using FP&A software is a highly structured and strategic process. By integrating this technology into the financial planning process, startups can gain a competitive advantage, ensuring their financial health and longevity in the business landscape.

Learn More

Unleash the potential of your startup by diving deeper into our enlightening blog posts about FP&A software, a game-changer for your financial planning and analysis. They are encouraged to explore our comprehensive and unbiased rankings of the Best FP&A Software for Startups, a valuable resource for making informed decisions.

Popular Posts

-

6 Compelling Reasons Why Startups Need FP&A Software for Optimal Financial Management

6 Compelling Reasons Why Startups Need FP&A Software for Optimal Financial Management

-

Debunking 10 Myths About FP&A Software for Startups

Debunking 10 Myths About FP&A Software for Startups

-

10 Things I Wish I'd Known About FP&A Software for Startups Before Investing in One

10 Things I Wish I'd Known About FP&A Software for Startups Before Investing in One

-

What are FP&A Software Solutions for Startups and How Do They Work?

What are FP&A Software Solutions for Startups and How Do They Work?

-

Ask These Questions to a FP&A Software Provider to Choose the Right Solution for Your Startup

Ask These Questions to a FP&A Software Provider to Choose the Right Solution for Your Startup