What are FP&A Software Solutions for Startups and How Do They Work?

- November 04, 2023

- 2 minutes

Financial Planning and Analysis (FP&A) software solutions are critical tools decision-makers employ to shape their organization's financial direction. For startups, these tools can be particularly invaluable, given the unique challenges inherent to their early stages, including resource constraints, uncertain revenue streams, and the pressing need to demonstrate growth to stakeholders. This post will delve into the nature of FP&A software solutions designed for startups, exploring their functionalities, benefits, and operation.

FP&A software solutions are digital platforms that facilitate budgeting, forecasting, financial reporting, and analysis. They employ mathematical and statistical models to provide insights into a company’s financial health and its future prospects. These tools are particularly relevant for startups as they help to manage the inherent financial uncertainty and volatility.

For startups, cash is king, and preserving cash flow often becomes the primary operational objective. Here, FP&A software shines. It enables startups to create dynamic financial models that can adjust in response to changing business conditions. These models can flow into budgeting and forecasting tools to project future cash flows under various scenarios and assumptions, enabling real-time decision-making.

Moreover, these software solutions automatically consolidate data from disparate systems, eliminating the need for manual data gathering and spreadsheet-based analysis. This automation not only saves time but also reduces the likelihood of errors that can occur in manual data manipulation.

Furthermore, FP&A software can generate comprehensive financial reports, tracking key performance indicators (KPIs) that matter for startups, like customer acquisition costs, monthly recurring revenue, and burn rate. These reports can be shared with external stakeholders including investors and board members, promoting transparency and fostering confidence in the startup's potential.

Now, how does an FP&A software solution work? In essence, these tools collect data from various sources such as accounting systems, human resources platforms, customer relationship management (CRM) systems, and more. They then process this data using mathematical and statistical algorithms to generate financial forecasts, budgets, and analytics.

The underlying technologies vary across different FP&A software solutions. Some employ traditional statistical techniques such as regression analysis and time-series forecasting. Others incorporate more advanced machine learning algorithms to identify complex patterns in data and make more accurate predictions. There's a trade-off here: while machine learning-based solutions can potentially deliver superior results, they require more data and are prone to "overfitting," where the model becomes too tailored to past data and performs poorly on new data.

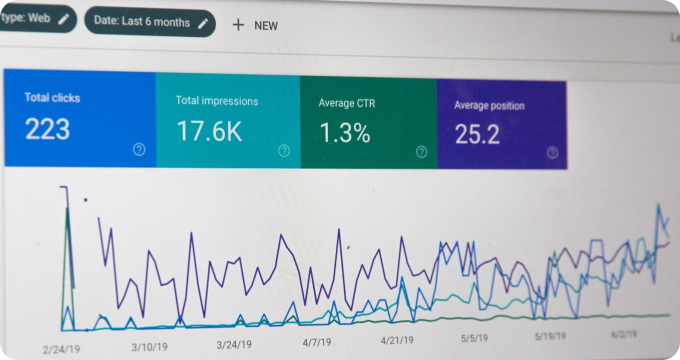

Moreover, these software solutions also offer interactive dashboards and visualization tools. By illustrating data in a visually engaging manner, they enable decision-makers to quickly digest complex financial information and identify trends and patterns.

An important aspect to consider when choosing an FP&A software is its scalability. As startups grow, their financial complexity increases. They may expand into new markets, launch new products, or acquire other companies, all of which can dramatically change their financial landscape. Thus, the ideal FP&A software for startups should be able to accommodate this growth, seamlessly scaling its capabilities as the startup evolves.

In conclusion, FP&A software solutions are powerful tools that can help startups navigate their challenging financial terrain. By providing robust budgeting, forecasting, reporting, and analytical capabilities, these tools can empower startups to make data-driven decisions, manage their cash flow effectively, and ultimately drive their growth. However, when selecting an FP&A software, startups must carefully consider its scalability and the suitability of its underlying technologies to their specific needs.

Learn More

Unlock the potential of your startup by diving deeper into our enlightening blog posts about FP&A software, your secret weapon for financial success. For an unbiased, comprehensive view, they are encouraged to explore our meticulously curated rankings of the Best FP&A Software for Startups.

Popular Posts

-

6 Compelling Reasons Why Startups Need FP&A Software for Optimal Financial Management

6 Compelling Reasons Why Startups Need FP&A Software for Optimal Financial Management

-

Debunking 10 Myths About FP&A Software for Startups

Debunking 10 Myths About FP&A Software for Startups

-

10 Things I Wish I'd Known About FP&A Software for Startups Before Investing in One

10 Things I Wish I'd Known About FP&A Software for Startups Before Investing in One

-

What are FP&A Software Solutions for Startups and How Do They Work?

What are FP&A Software Solutions for Startups and How Do They Work?

-

Ask These Questions to a FP&A Software Provider to Choose the Right Solution for Your Startup

Ask These Questions to a FP&A Software Provider to Choose the Right Solution for Your Startup